ABOUT

A global framework

for responsible ship finance

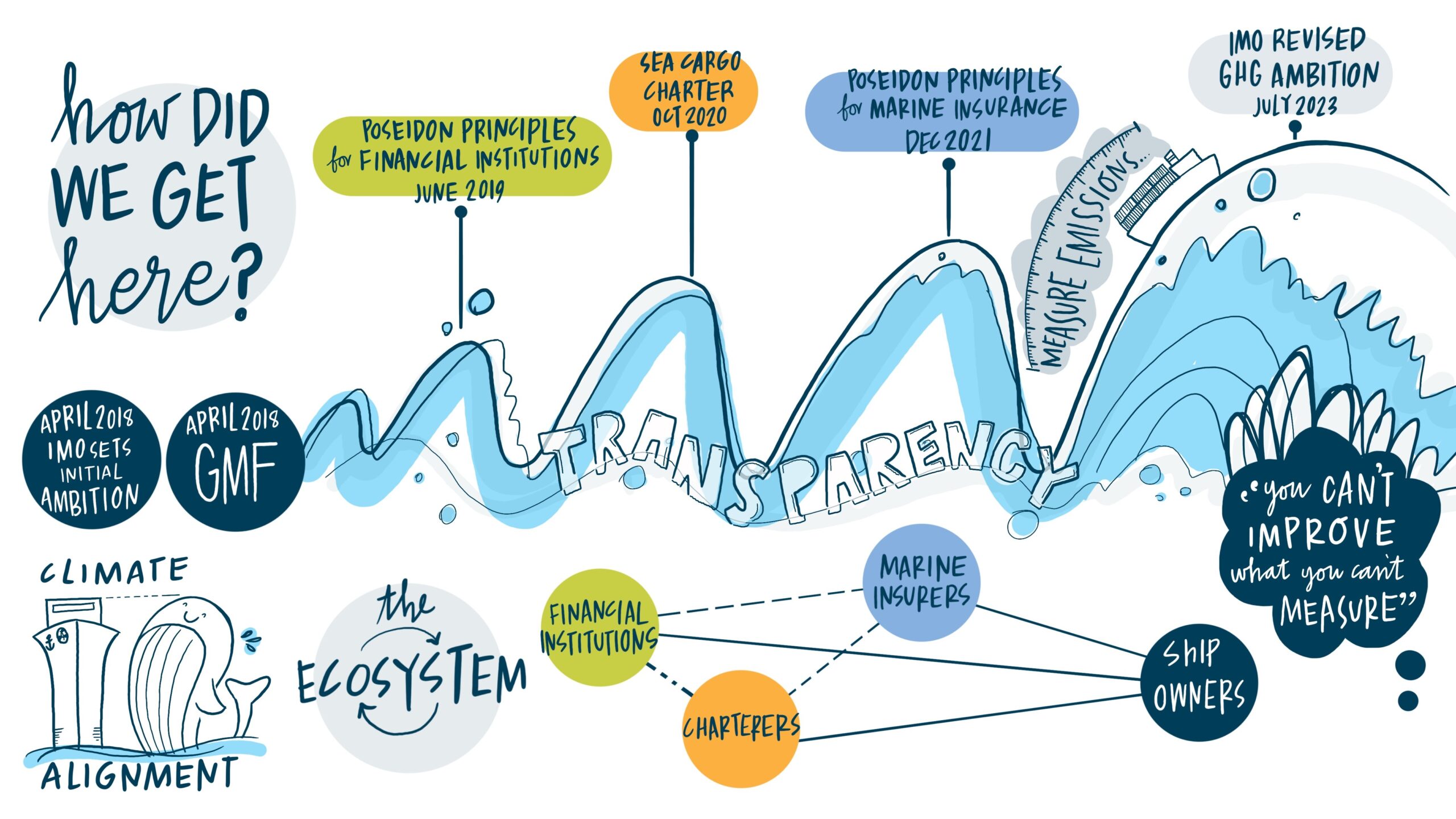

The Poseidon Principles are a global framework for assessing and disclosing the climate alignment of financial institutions’ shipping portfolios. They establish a common, global baseline to quantitatively assess and disclose whether financial institutions’ lending portfolios are in line with adopted climate goals. Thus, they also serve as an important tool to support responsible decision-making.

The Poseidon Principles are applicable to relevant lenders, lessors, and financial guarantors, including export credit agencies (ECA). signatories must apply the Poseidon Principles to all business activities:

- that are credit products (including bilateral loans, syndicated loans, club deals, and guarantees) secured by vessel mortgages or finance leases secured by title over vessel or unmortgaged ECA loans tied to a vessel; and

- where a vessel or vessels fall under the purview of the International Maritime Organization (IMO) (e.g. vessels 5,000 gross tonnage and above which have an established Poseidon Principles trajectory whereby the carbon intensity can be measured with IMO Data Collection System (DCS) data).

The Poseidon Principles are consistent with the policies and ambitions of the IMO, a UN agency responsible for regulating shipping globally, including the 2023 IMO GHG Strategy (formally known as the 2023 IMO Strategy on Reduction of GHG Emissions from Ships or Resolution MEPC.377(80)). This revised ambition states that emissions from international shipping should reach net-zero by or around 2050 compared to 2008 levels, with interim targets in 2030 and 2040, and considers full lifecycle emissions in a “well-to-wake” CO2e perspective.

Currently, 35 financial institutions are signatories to the Poseidon Principles, representing a bank loan portfolio to global shipping of over 80% of the global ship finance portfolio. Signatories commit to implementing the Poseidon Principles in their internal policies, procedures, and standards and to work in partnership with their clients and partners on an ongoing basis to implement the Poseidon Principles.

The Poseidon Principles are intended to evolve over time to include other issues where the collective influence of financial institutions can help improve the contribution the industry. Additionally, some signatories may choose to go beyond the global baselines established by the Poseidon Principles which offers significant benefits to the signatories, to the global maritime industry, and to society as a whole.

TRANSPARENCY INITIATIVES

The Poseidon Principles are part of three transparency initiatives based on the same four Principles and developed by the Global Maritime Forum with the shared aim to decarbonise shipping.

During the very early stages of the development of the Poseidon Principles, some charterers, who were part of the drafting group, voiced the need for a transparent process for reporting emissions relating to chartering activities. This is how the Sea Cargo Charter was launched in October 2020. The Sea Cargo Charter provides a global framework for aligning chartering activities with responsible environmental behaviour to promote international shipping’s decarbonisation.

The Poseidon Principles for Marine Insurance is the most recent initiative that was launched in December 2021, gathering a group of marine insurance institutions committed to aligning their portfolios with responsible environmental impacts.

All three initiatives are aligned with the 2023 IMO GHG Strategy which aims for net-zero emissions from international shipping by or around 2050.

POSEIDON PRINCIPLES

Get in touch

Where to find us

Amaliegade 33 B, 3rd floor

1256 Copenhagen K

Denmark

VAT Number: 40632379